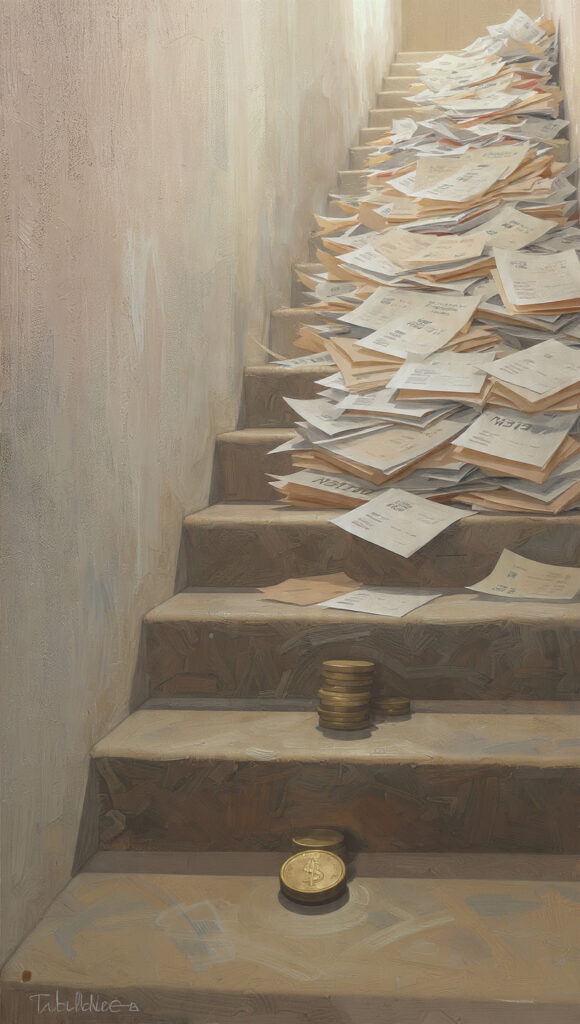

Some people treat poverty as a static condition, a temporary inconvenience, a challenge to endure, or worse, a lifestyle to accept. But poverty is not just about the lack of money today; it is about the compounding consequences of neglect. And the truth is simple: Poverty charges interest, and the longer you delay investing in yourself, your health, or your responsibilities, the higher the cost becomes.

The Hidden Cost of Neglect

When you skip small but essential expenses today, it almost always leads to bigger, unavoidable costs tomorrow. For example:

- Health: If you can not afford basic dental care now, you may face expensive root canals later. Skipping annual checkups or ignoring early signs of illness can escalate into critical medical bills.

- Comfort and Rest: A worn-out mattress might seem like a minor expense, but poor sleep over time can contribute to severe health problems, from back issues to weakened immunity, and eventually requiring costly treatment.

- Home and Safety: Delaying repairs or maintenance may seem like saving money, but it almost always results in structural damages that are far far more expensive to fix later.

So in essence, poverty is not just a present problem; it accumulates penalties over time, just like interest on a loan.

Understanding the Principle: The principle is simple: Neglect has a cost. Just as you would not ignore a credit card debt, you should not ignore your personal well-being, essential purchases, or preventive care. These are not optional; they are investments in avoiding future loss.

Every small, unpaid expense, overlooked health check, or deferred repair carries a hidden “interest rate” that compounds over time, and ultimately demanding payment in ways that are harder, more painful, and even sometimes worse, irreversible.

How to Break the Cycle

Breaking the cycle of poverty interest is less about sudden wealth and more about strategic choices and discipline:

- Prioritize Essential Needs: Make a list of what you can not afford to delay, like healthcare, nutrition, basic maintenance, and education.

- Plan and Budget: Allocate resources intentionally; even small amounts set aside regularly can prevent large emergencies.

- Invest in Yourself: Education, skill development, and personal health are investments toward future financial and personal security.

- Avoid Deferred Consequences: Recognize that skipping small expenses or responsibilities today will most times guarantee higher costs later.

- Practice Preventive Action: Like insurance for life, spending wisely on prevention is cheaper than paying for crises.

Financial wisdom is not only practical; it is spiritual and mental, and Proverbs 21:5 says: “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” So, my dearest readers, careful planning and investing in essentials are forms of diligence, and ignoring this principle may lead to both material and emotional stress, compounding poverty’s impact over time.

Read Also: Ways To Invest in Yourself And Build A Better Life

Read Also: Resist The Urge to Perform: The Freedom of Not Performing for Others

Read Also: The Creeping Normality: How Small Changes Lead us to Big Problems

Conclusion

The lesson is very very clear: Poverty is not neutral; it grows if left unchecked. Every small neglect carries a hidden cost, and these costs accumulate over time. By prioritizing essential expenses, investing in your health, and planning wisely, you prevent the compounding interest of poverty and protect your future.

So again and in short: Do not wait to pay the price later, invest wisely today, and your tomorrow will thank you.